Author: Cam Wayland

Vendors often measure, profile and segment their partners and their distributors based on revenue performance. Rarely do they dig deeper to look beyond the numbers to what is actually driving the revenue via distribution.

When it is working well you will usually find there is “alignment” between the capabilities, resources, and vendor portfolio of the distributor to the targeted channel partners and their customers. When it is not working well, you can generally assume that ‘alignment’ is either off or in the worst instances, completely missing. So what does alignment actually look like? Let’s find out.

Are You Aligned?

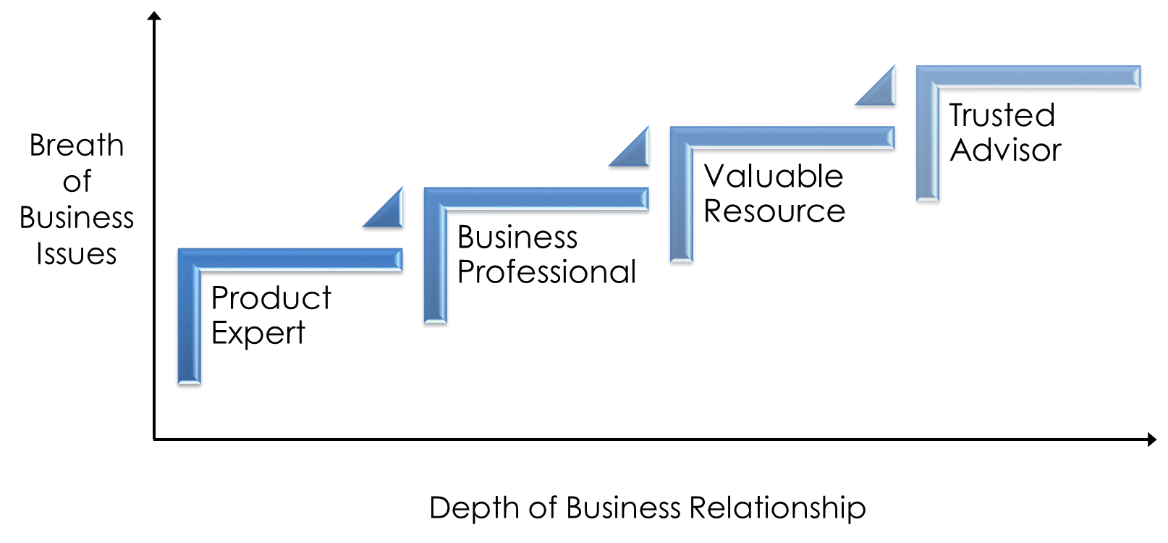

High performing channels are where there is alignment of the value proposition, solution and business model – starting at the Vendor, flowing through to the distributor, then the partner & finally the customer. Sounds simple, but often is difficult to sustain on an ongoing basis given the changing nature of technology and customer preferences.

Channel Dynamics’ DynamicDSI model helps to explain and work through the alignment challenge. Firstly, you must:

- Define the target customer/market for your products or services, then,

- Select the appropriate partners (and distributors) that have the necessary skills and location to reach these customers and finally,

- Implement the necessary channel support processes, programs and resources so that your channel partners can meet the needs of your customers, profitably.

If done in this order you should end up with an aligned and efficient channel.

While this seems logical, aligned channel design requires thought. E.g. The needs and buying preferences of a SMB end user are very different from that of a larger enterprise customer. Therefore, the skills and business models of partners and their distributors targeting these different customers will vary considerably, and of course so will the vendors’ requirements.

The example below illustrates some of these differences across the GTM supply chain.

Some of the larger broad-based distributors have overcome this alignment challenge of vendor/channel/customer by creating standalone business units. I.e. where like vendors and technologies targeting similar channel partners are grouped together for efficiency and skills. An example of this is complex networking, cloud/software licensing versus logistics with pick and pack for retail or SMB.

Other smaller or more niche focused distributors often have much tighter vendor portfolios but with deep skills to target and support the ideal partner with a range of value added activities.

Alignment “creep” can occur over time and can be caused by any one of these examples.

To prevent, or at least manage alignment creep, you must ensure there is a structured review of joint operational and business objectives. Ideally a business review would occur every quarter or at an absolute minimum, twice a year.

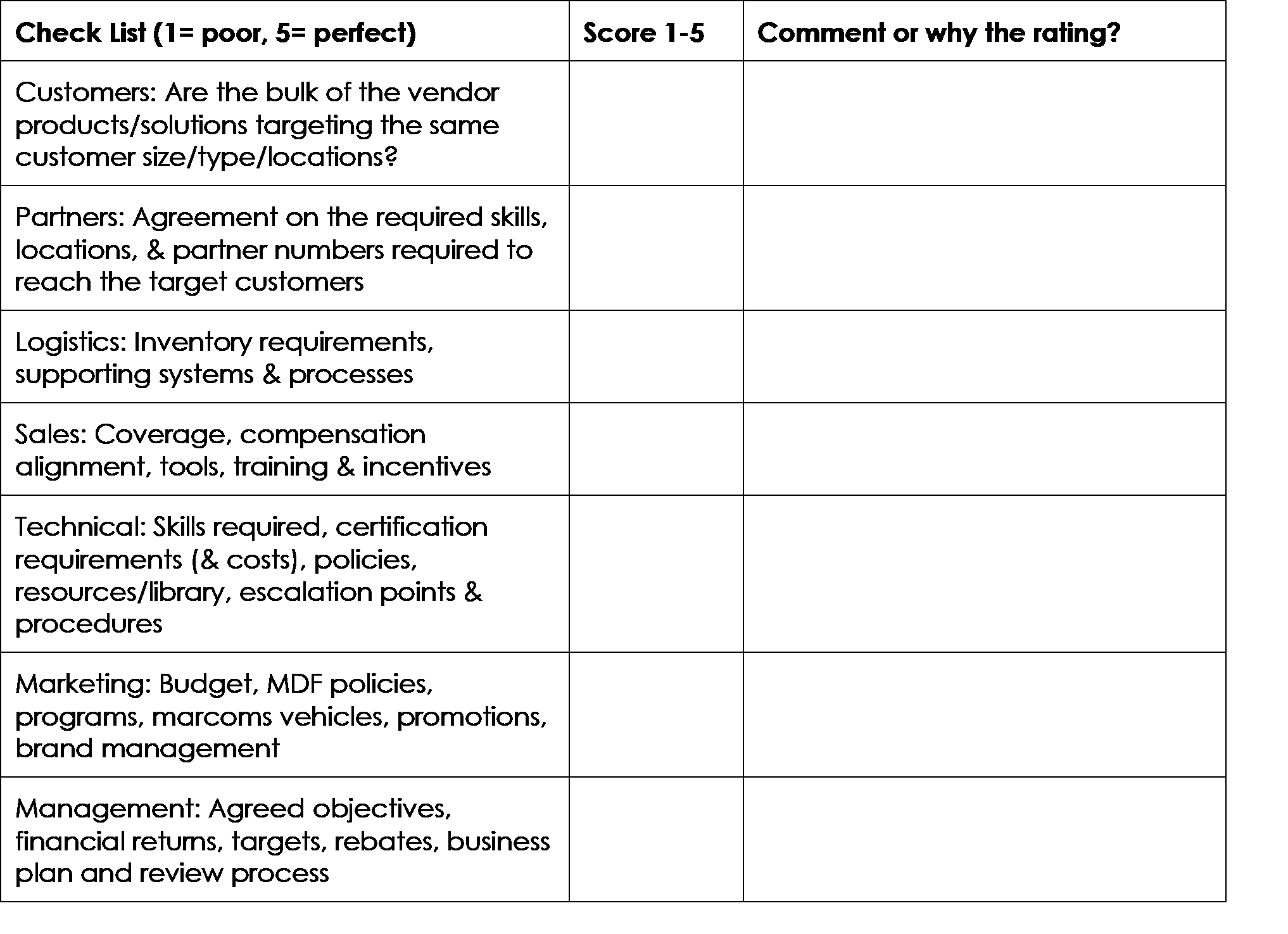

Alignment Check List

Below is a table we like to use to help determine how aligned an organisation is with the rest of their channel. This table lists the basic elements of alignment used to score a company through the eyes of their distributor.

The assumption in the above list is that the vendor has a quality product the customers want or need, that it is priced appropriately, and that there are suitable promotional activities to generate awareness i.e. 3 of the 4 P’s of marketing. These are core vendor led responsibilities.

A well designed and resourced partner program is essential for helping to drive alignment. Programs are fundamentally a set of business rules with matching requirements and benefits to help to guide distributors and partners as to what to do, how to do it, and where to invest.

If you achieved a low score (<20) chances are you are having alignment problems with implementing or executing your channel initiative, which could result in a lower than anticipated sales performance, or higher costs.

Monitoring and managing ongoing alignment are at the centre of a structured business planning and review process. A good way to start the planning conversation between the vendor and its distribution partner can start with a simple question:

Are we all heading in the same direction and do we each know what we must (and can) do to get there, profitably?

With so many moving parts within a vendor/distributor relationship it really is imperative to run frequent (3 -4 per annum) formal and structured business reviews. Additionally, identifying, agreeing upon and then monitoring key performance metrics on a daily or weekly basis it critical. The output of these metrics will form the basis of each subsequent business review and help determine any changes (good or bad) in overall business alignment.

Best practice for building and maintaining distribution alignment

In summary alignment is critical to vendor/distributor partnership success and while there are many components and influences on alignment, there are things that you can do to both build and maintain distribution alignment. These include:

- Start at the beginning to check your offering is still aligned to the target market or customers via your existing channel coverage and capabilities.

- Define clearly what you want the distributor to do, what the partner will do, and what you as the vendor will do.

- Ensure your channel compensation system margin, rebates etc matches what you expect your distributor and partners to do, profitably.

- Confirm your program rules, requirements and benefits are clearly documented and communicated so everyone knows what to do and how to do it.

- Make certain that regular, structured business reviews are conducted to manage any alignment creep and update or adjust any rules of engagement and business plans as needed.

If any of this seems complex, or you’re looking for advice on how to implement these ideas with minimum disruption to your business, you can reach me at cwayland@channeldynamics.com.au